FROM HEADWINDS TO TAILWINDS?

The last three years have dealt a fair number of low blows to investors. In fact, the last five years have provided turbulent times and disappointing returns on a wide scale for everyone outside the US, and in SA this period can be extended way past the five-year period…

Have the winds finally changed from a head-on storm to a light tail breeze?

Firstly, I want to say (and I am probably going to be crucified for it) that I am personally delighted that interest rates have started moving upward globally, albeit way too late and too aggressive. The abnormal environment that we found ourselves in started to materialise during the global financial crisis (GFC) in 2007 where companies were bailed out – some of which should have been allowed to fail– where cash became free due to interest rate cuts, and stimulus placed cash in the pockets of everyone in the developed world during Covid (more so in the US than elsewhere). It was a recipe for disaster. A market where people were unemployed yet had more disposable cash than at any other time, interest rates at all-time lows and zero to negative inflation had all the makings of a bad ending…

At last, normality is starting to return to global markets. The world economy needs positive interest rates and inflation (within reason) to function efficiently. Abnormal interference in the economy leads to distortions of demand, prices and most importantly investor behaviour. Throw a European war into the mix and oh boy, things really start to get crazy!

So, what headwinds have turned to tailwinds? On every front, we can see a change of direction. Be careful, however, not every change is a good one and some may lead to a less favourable outcome like, for instance, a recession. The pathway forward is far from clear but at least the expected outcome is better than a year ago. Consider the following:

Inflation

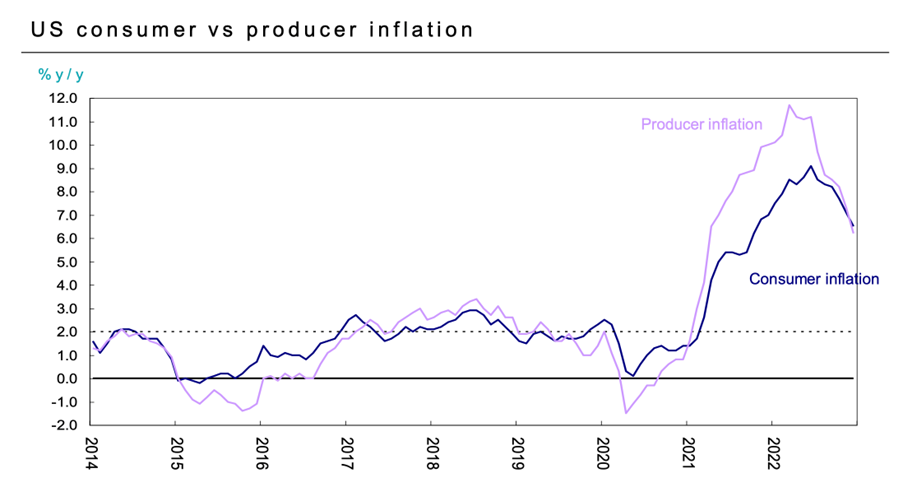

It is generally accepted that global inflation has peaked and is headed towards normality. In the US, the figures below indicate that both producer and consumer inflation are declining.

Lower inflation is evident across the globe including in SA. The warmer-than-normal winter in Europe has taken the pressure off the demand for gas, reducing the international gas price drastically which in turn has reduced inflation in Europe and Britain.

Bear in mind, however, that lower inflation does not mean lower prices. It merely means that prices will increase by a lower margin than the previous measured period. We often forget that. The pressure on consumers will remain especially with interest rate hikes coming through often and strongly…

What is the tailwind?

In an environment where inflation reduces interest rates tend to follow. Bonds thrive in such an environment and equity + type of returns are very possible from the bond market when inflation and interest rates roll over.

Interest rates

Thanks to the denial of politicians who did not believe that inflation was “sticky” after Covid, but rather “transitory” (a newly created word), developed markets (the US in particular) were forced to embark on the most aggressive interest rate hiking cycle in remembrance. An earlier less aggressive rate hike cycle that lasted longer would have been preferable, but it is what it is.

This aggressive interest rate hiking cycle led to one of the most spectacular international bond market crashes ever recorded. It also led to massive pullbacks in global equity markets creating a scenario of the first simultaneous collapse of the US stock and bond markets in more than 50 years. Under normal economic conditions, these asset classes are negatively correlated and mostly perform in opposite directions given different interest rate cycles. But these were not normal times. I state again, I am happy that normality is returning…

It does, however, seem as if interest rate hikes are close to their peak and that the initial aggressive stance of central banks has been tempered a bit. This will be a welcome relief for indebted citizens both globally as well as locally. Once this is confirmed, we wait with bated breath for interest rates to start reducing and bond investors to shout hallelujah! The market anticipates for this to start happening in early 2024. Income fund managers must be rubbing their hands because bond markets price in movements before they actually happen…Let’s hold thumbs that expectations are met.

Equity markets and recession

It is broadly expected that the world will experience (is already experiencing?) some form of recession. The extent or probability of the recession will be driven by the world’s two largest economies namely China and the US.

The US keeps on surprising with their unemployment figures and as long as US unemployment/full employment remains at these levels, the extent of a recession will be less severe or averted. For a recession to kick in hard the US employment figures must deteriorate. There is a trend of reducing earnings of US companies which may lead to job cuts, but we will have to see how this plays out. There are currently more than 11 million job openings in the US.

The S&P 500 is broadly still expensive. However, there are pockets of value opening up that stock pickers are taking advantage of. It is unlikely that the S&P 500 Index will continue its 10-year+ trend to outperform everything during 2023/2024. Once again, thanks to normality returning.

China has, at last, re-opened its economy after severe lockdowns due to Covid. They have also started relaxing regulations after severe clampdowns on certain business sectors. China’s communist policy to enhance the lives of all people should also be a driver of Chinese consumerism. Due to lockdowns, bottlenecks within the global supply chain started to get worse. The re-opening of their economy should see an improvement in supply which should benefit the global economy. Their lockdown also resulted in stockpiles of resources reducing, these now have to be replenished which should benefit SA. We will have to keep an eye on their oil consumption.

The graph below indicates how much their oil stocks have reduced. An aggressive replenishment of their oil supplies may just increase global oil prices and we know what rising oil prices do to inflation. Then there is their property over stock problem that we need to bear in mind. This may be a drag on commodity demand.

Equities in SA like all other assets in SA have the big “E” hanging over their heads. SA Inc will undoubtedly be affected by ESKOM. Fortunately, the vast majority of income generated by JSE-listed companies is generated off SA shores. Many investors grapple with the fact that irrespective of Eskom’s woes, the JSE is sitting at an all-time high. Foreign earnings and company valuations are the drivers of this trend, and many managers still favour SA shares over their offshore counterparts. Many shopping centres and mines have installed their own power generation and we expect this trend not only to continue but to accelerate. Let’s hope SA’s power situation improves soon.

So, all things considered, what do we expect from asset classes in 2023? The graph below indicates NinetyOne’s expectations for 2023 compared to 2022. Different asset managers and analysts have different views, but the below graph is pretty much how most see it. Some managers, however, switch their offshore and local expectations around favouring SA equities over offshore equities.

My one concern, however, is the strong start of the year in 2023. Markets across the globe have improved by give or take a couple of percentage points, around 10% in the first month. This may just be the bulk of returns that we may experience during 2023. This may also spell heightened volatility as markets grapple with a global normalising economy. We will have to close our volatility-sensitive eyes and maybe, just maybe, double-figure returns on a broad base are on the table.

Long-term return expectations, however, are much better than what they were 12 months ago. In my opinion asset allocation and stock picking will be the determining factors over the medium to long term. Don’t expect what worked over the past five and 10 years to work over the next five to 10 years. Historical returns mean nothing when choosing funds for the future. In a market where inflation and interest rates return to normal after a very long time of absence and abnormality, the managers who have the most foresight and can identify the companies that will flourish in the “new normal” will be the ones that will add value. Once again, in my opinion, active management will trump passive management (index funds) and value investing will trump growth-style investing.

The start of 2023 is a perfect example of my regular comment. You have to be in it to win it. For those who were, well done. For those who weren’t, there is still upside left BUT IT IS A LONG GAME…

In summary, I conclude with the following table:

Happy investing!