I KNOW EXACTLY WHERE THE MARKET IS GOING…

… But does it matter?

The investment market is smothered in smoke, mirrors, and misinformation that sometimes borders on lies.

It is interesting to witness the impact of emotional marketing tactics in two areas.

Firstly, that SA is doomed, and all assets should be taken offshore. It is evident that this message gets ramped up when the rand slides or something goes wrong with infrastructure or politics. Do you notice how the noise has quietened down since the GNU and with the rand at sub-R18? I bet the clouds of thunder and roaring to move abroad are just waiting for the next round of bad news …

There is nothing wrong with investing offshore; quite the contrary. The problem is the reason for investing offshore and when the funds are taken abroad. What you pay (or forfeit) still matters.

Secondly, low fees are the main driver of investment returns. Undoubtedly, fees impact returns, but lower fees are most certainly not a guarantee of better returns …

Some fund managers and advisors have perfected their marketing skills in these areas and attract massive funds. I am all for offshore investing and low fees, but some perspective is necessary, and it most certainly is not an all-or-nothing game.

I get annoyed by statements from professional fund managers and marketing departments that massage figures to suit their period-specific performance. I get equally annoyed by investors who take everything they hear as gospel and then, in turn, either get mind-boggled or really believe statements they make.

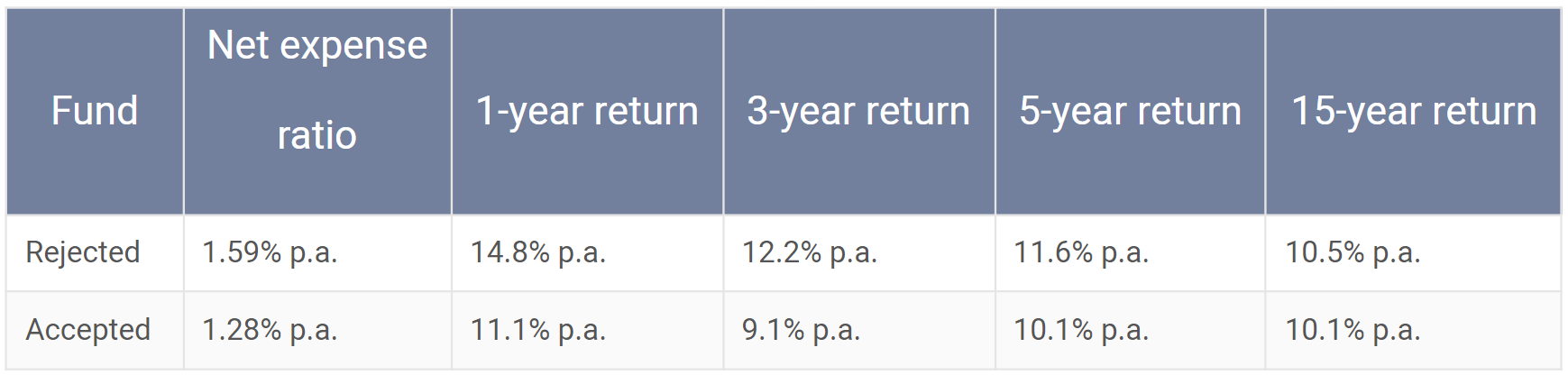

Recently, a potential client told me that he decided not to invest with one of the major fund managers because their staff wears designer clothes, has glamorous offices, and charges 5% per year in fees. I did not argue or try to correct this wildly incorrect statement. He chose to rather invest with a manager who has industrial-type offices, charges lower fees, and their staff dresses conservatively. What are the facts of the two fund managers mentioned above?

Comment:

The rejected fund outperformed the client’s fund’s overall meaningful periods. The client did not know this. He was blinded by perceived fees.

The long-term returns (15 years) of both funds are very similar.

Both funds charge performance fees (which the client did not know). The rejected fund was only “cheaper” due to weaker performance, which led to lower performance fees. However, fees of the “rejected fund” are a far cry from the 5% that the client perceives.

Both funds are good funds with similar long-term returns. They are not correlated, and the chances are good that the accepted fund will catch up with the rejected fund if the fund manager’s current conservative approach plays out.

This brings me to my next peeve …

This time, passive fund managers are more guilty than active fund managers. According to passive fund managers, the main driver to motivate why one should use passive funds for superior returns is the impact of fees. According to them, you will get better returns if you pay less for a fund. While this is true if you use exactly the same underlying investments, it does not necessarily guarantee you better returns just because you are paying less in management fees where different strategies apply. If this holds true, then passives will outperform in all cases where they compete in the same asset class.

Why, then, do passive equities lag hedge funds by 4% per year over all periods longer than three years? Currently, for over one year, hedge funds have outperformed passive equities by more than 1%. This is while some hedge funds regularly charge more than 6% per year. I want to remind you that returns are always quoted after fees. This is not my punt for you to start using hedge funds. It is merely a statement; however, do so if you wish and only if you understand their pricing and risks, especially geared funds.

It is a common strategy of passive managers to quote annual costs of active managers of “more than” 3.5% per year. There was an article on Moneyweb recently that again made all the above statements. The Morningstar data of 28 August shows that in the balanced fund space, there are 23 funds out of 214 that charge more than 2%, none at above 3% and of these only three managed more than R500 million. The same is evident in the equity space where nine out of 173 funds charge above 2%, with also only three that manage above R 500 million.

We know that it costs more to manage a smaller fund and the trend is clear that fees come down as fund sizes increase. To generalise and inflate actual numbers is borderline devious, especially when you elect not to include administration fees and advisor fees in the costs of passive funds.

I assure you that many advisors, including myself, include passive funds as part of their investment strategies. It is not only direct investors that opt for the passive approach, so why exclude admin fees and advisor fees from your comparison? Even with advisory and admin fees included, passives will still be cheaper than actives, so there is no need to exaggerate the difference …

Apart from stating the impact of fees, passive managers also love to make the following statements:

That more than 70% of active managers underperform their benchmark. This may be true, but why don’t they counter this by saying how many passive managers underperform their benchmark? The simple answer is that 100% of passive equity managers underperform their benchmark because they can only, at best, get market returns minus their fees. I cannot help to think that this is a strategic tactic to mislead investors. If we consider this fact, then active managers have a better track record than passive managers, with at least a 30 % (if this figure is correct) chance of outperforming compared to the 0% chance of passive funds.

In the multi-asset space, fund managers often use the sector average as the benchmark. This applies to both active and passive managers. Although there is probably no malice intended with this statement and measure, it requires some explanation and clarity. I want to go so far as to say that any fund manager who is worth their professional reputation has an above-average chance of beating this benchmark. Why do I say this? Consider the following facts of the funds represented in the high equity (balanced fund) space:

Currently, there are 214 funds registered in the sector, according to Morningstar:

The average size per fund is approximately R4.4 billion;

109 funds manage less than R500 million (small to insignificant);

52 managers manage over R2 billion; and

Many of the registered smaller funds are “white-labelled” broker funds and should not be considered professional-run funds. Quite frankly, they are not even available to the investor public via the popular LISP platforms. In my opinion, these funds should be excluded from the “average benchmark”. It is questionable how many of these funds will still be around in the next five years. Some are diluting the average returns with a return differential of more than 10% per year over three and five years between the best and worst performing funds. This does not mean all small funds are “bad”. On the contrary, there are some excellent, well-run, smaller funds.

Perhaps a composite benchmark where a percentage of the various asset classes locally and offshore are used to determine an appropriate benchmark makes more sense. Some fund managers adopt this approach, and kudos to them.

Market forecast

Moving on to my crystal ball and my forecast of what the markets and the rand are going to do. We all know that this is crucial information and that many investors go through hundreds of articles and opinions to try and time the market and get the allocation to local, offshore, currencies, equities, and bonds spot on.

Currently, there are varying opinions that range from expected rate cuts to rates rising soon again (if inflation rises through spending sprees due to lower rates), inflation coming down or rising for the same reasons mentioned prior, a severe recession due to world debt to a massive market rally due to more disposable income, a tech boom due to AI to a tech bubble bust due to elevated prices.

I am going to borrow Dave Foord’s analysis of the markets and the rand. I know exactly what it’s going to do. It’s going to move up or down – guaranteed! Why worry? Diversify, choose the right fund managers who are convincing and who have strong arguments and combine them with uncorrelated managers who have equally strong opinions. Think it through and adopt the combined strategy that you are most comfortable with. Don’t use the rearview mirror strategy. A combo between active and passive makes sense.

Remember, today’s best fund managers were probably much further down the rankings one and three years ago, and the same is likely to happen to today’s best fund managers, who may underperform next year. At some point in time, all fund managers, or shall I rather say most fund managers, have their time to shine and provide stellar returns. Remember why you chose your fund manager, and don’t turn your back on them should they have a slight pullback. They may just be positioned for some of the bad news in the market …

Whatever you do, remain invested and don’t move to cash with your long-term funds and stay invested within your risk profile.

I can already see the comments that owning the market eliminates this problem and that passive outperforms active. I am not convinced. As I said, all funds and strategies get their time to shine. Considering the elevated prices of the S&P, the next five years may just belong to the active managers as they did in the decade that followed the tech crash in 2001 … Maybe there will be a shift from the US to the East, where tech stocks are much more affordable and where they are busy with significant developments. But does it really matter? All managers have compelling views. Find tomorrow’s stars, and remember that they are not necessarily yesterday’s heroes …

I hope my “forecast” will help you in your quest to structure the perfect portfolio. Keep calm, stay safe and remain invested.