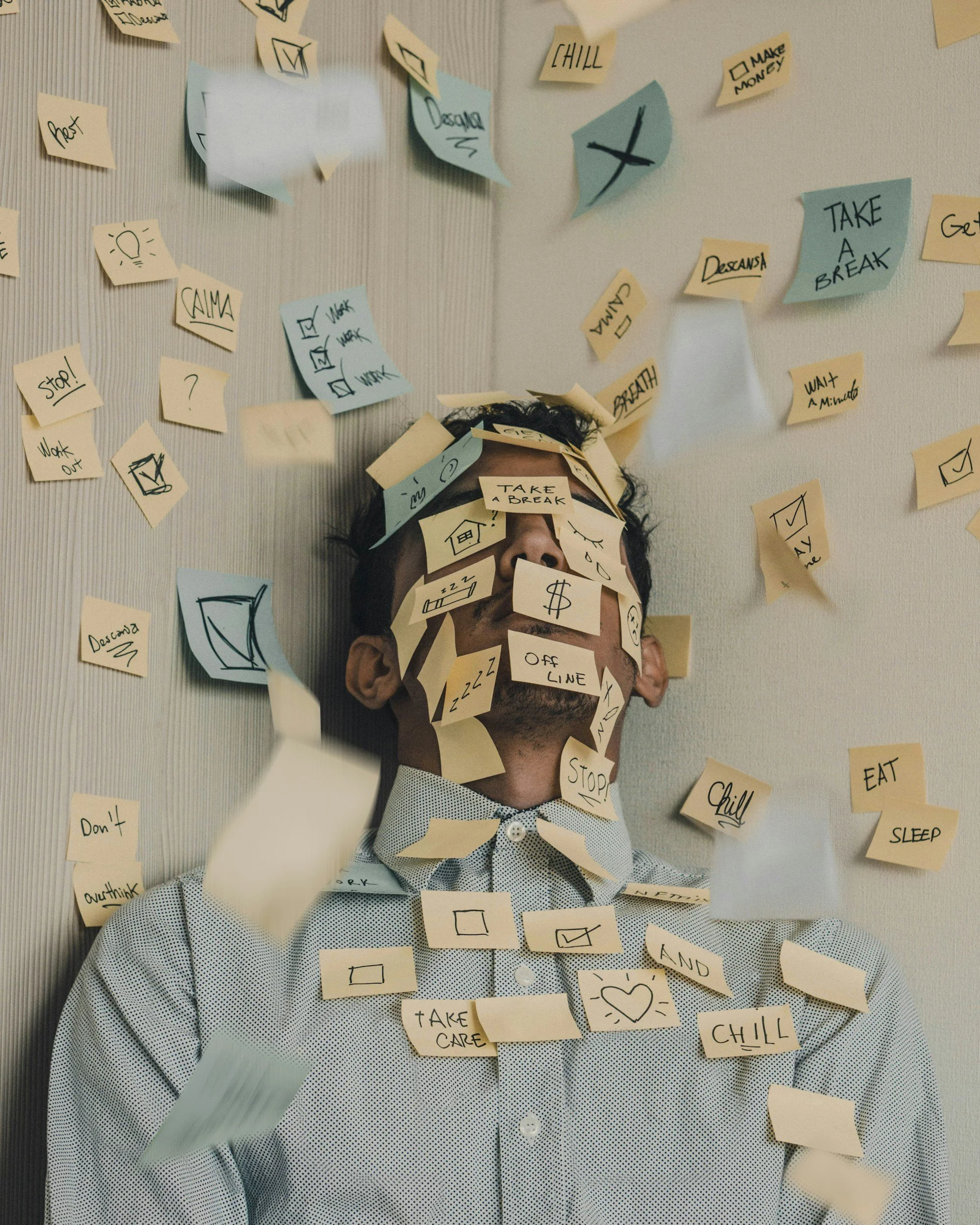

MANAGING INVESTMENT ANXIETY

A look at what approach you should adopt to experience decent returns at acceptable anxiety levels.

All investors suffer from investment anxiety. The trick is to discover what triggers these feelings and at what level these feelings are awakened.

Similarly to volatility, where investment returns move upward and downward around the mean, anxiety can be experienced during market cycles when returns turn negative and during bull markets when markets turn positive. When anxiety occurs when markets provide consistent positive returns, it is mainly because “not enough” returns were experienced.

Just like emotions drive investor behaviour (fueled by fear and greed), anxiety is caused by the same emotions:

Fear of loss causes anxiety when markets turn negative or when a market correction is anticipated after a strong run. Market news and anticipated market adjustments are significant drivers that cause investment stress.

Remorse/anxiety occurs when returns are lower than the market has produced. Generally, this can be attributed to greed.

The fear of loss has a much more significant emotional impact than the anticipation of a gain.

I am fascinated by how investor behaviour changes during different market cycles. I find it entertaining when markets swing between negative and positive and back to negative again and witness how investor’s “risk profiles” change.

That questions the feasibility of risk profiling. The outcome of a pure risk-based risk profiler will be influenced by recent market movements and the investor’s resultant state of mind when doing the risk profiling. Determining an investor’s risk personality and how they will react during different market conditions is much more meaningful.

We always joke and state that the typical investment client expects maximum returns at all times with little volatility and no negative returns. They also expect perfect prediction and spot-on market timing. This requirement is a bridge too far … If you do not want to experience negative returns, you must remain in cash, and that is not a workable solution unless the funds are held in a special trust where no taxes apply or as a taxpayer, you are taxed at the lower end of the tax scales. You may as well spend your money if you cannot beat inflation.

Before investing and deciding on an investment strategy, bear the following in mind:

Volatility is part and parcel of any investment with exposure to growth assets like equities, property, bonds and hedge funds. How much volatility can you stomach before you become anxious?

The higher the exposure to growth assets, the more volatility (negative and positive returns) will be experienced.

The more offshore exposure you have, the more volatility you will experience if you measure returns in rand.

Volatility reduces over time. The longer your investment remains invested, the less likely your losses will be.

Let’s look at some different investment strategies and see how long it generally takes to achieve a high level of certainty that you will no longer experience negative returns:

Cash: No negative returns over any period.

Income funds: Depending on the mandate, it is generally expected that income funds should not provide negative returns after 12 months. Where growth assets (for example, property) and offshore assets are included in an income fund, this period can increase to two years.

Low equity funds (maximum 40% equities): It is generally accepted that no negative returns should be experienced after three years. The more you add to offshore exposure, the more volatility you experience.

High equity funds (a maximum of 75% equities): It is generally accepted that no negative returns should be experienced after five years. Increased offshore exposure can increase negative periods when the rand strengthens.

Pure equity funds (100% equities): It is generally accepted that negative returns should not be experienced after seven years. However, offshore exposure will influence volatility and may extend the period of negative returns to longer than seven years, as we experienced from 2000 to 2012.

Note: The periods that I refer to, specifically the comment that no negative returns should be experienced, refer to negative returns of the original investment amount.

Example: If you invest R 1 million, and the value increases to R 1.5 million in four years and then drops to R 1.3 million in year five, have you lost R100 000, or have you made R300 000?

Many investors see the above as a loss of R100 000, which is wrong. Profits and losses can only be claimed the day you cash in and secure the investment value.

Guarantee: The one guarantee that I can give is that any investment that includes growth assets and/or offshore exposure will provide negative returns. The higher the exposure, the more periods of negative returns will be experienced.

Statement: Contrary to common belief, no one knows precisely where the market is heading. Irrespective of where the market is at, there are always the yay-sayers and the nay-sayers. Everyone has a compelling story and can motivate their opposing views. I often have to defend and explain that there is no “magic book or wand” that can determine the perfect portfolio and outcome. Markets are determined by investor behaviour and investors behave irrationally, making predicting markets impossible, especially when momentum drives investment decisions. Momentum can cause markets and certain market sectors to run hard for way longer than logic and valuations predict. This can make certain decisions and funds look foolish for the wrong reasons. All of which increases the level of anxiety of investors who are on the wrong side of the trend.

At some stage, all fund managers will be right. Your luck of the draw is when you have exposure to whom. Choosing uncorrelated fund managers is important to ensure all bases are covered.

Also, equities are not the only asset class, and even if you opt for passive funds, you still need to take an active decision to decide which passive funds to choose. There will be those who say, “It’s easy, just invest in the S&P500”. If you got that right over the past 10 years, well done. You would disagree if you were one of the investors who incurred permanent losses from 2000 to 2012 from the same index. Hindsight and past performance should not be the main driver of your investment decisions.

Diversification is still the most logical strategy to give you the best chance of decent returns. I say decent returns, not maximum returns. So, what approach should you adopt to experience decent returns at acceptable anxiety levels?

Use the guide I referred to earlier and choose a strategy that matches your investment horizon. If your investment term is one year, don’t invest in a pure equity fund. Similarly, do not invest in pure cash if your investment term is seven years.

Check the fund fact sheets of funds you consider to determine their historical maximum drawdown and how long they took to recover. If these facts are not shown on the fact sheets, request them from the fund manager or speak to a suitably qualified advisor who can guide you.

If the stated maximum drawdowns and recovery times don’t suit your anxiety levels, then consider a less volatile strategy and keep on doing that until you find a suitable solution.

Use at least three different uncorrelated fund managers. Remember, today’s best fund manager (measured by return) was probably way down the rankings one to two years ago, and it is likely that today’s best performers will swap places with the laggards next year or the year after. It is almost impossible to remain at the top of the pile year in and year out. If this were possible, such a fund would attract all the funds in the market.

As a “safety stop”, place two years of expenses or 20% of your investment in a cash fund as part of your investment. This will prevent you from drawing cash against the growth component should you need some money urgently, and at the same time, it would reduce the volatility of your portfolio.

Measure the overall return on your investment. Don’t single out funds, especially if you use uncorrelated funds – they will provide different returns during different market cycles.

Where possible, invest directly offshore and measure returns in the hard currency that you invested in. That will reduce volatility and anxiety since returns seem to fluctuate less than when measured in rand.

Decide on a required return and avoid trying to achieve maximum returns. This will make you an investor, not a speculator, and it will reduce your anxiety levels.

Happy stress-free investing!