THE OPTIMAL FUNDING THAT IS REQUIRED TO ENSURE A SUSTAINABLE LIVING ANNUITY

A guide to assist you along the way to retirement and in retirement.

Two of the biggest challenges and causes of financial stress when retiring are determining how much capital is needed and achieving enough returns to ensure sufficient income for the rest of one’s life. Add to this the need to preserve capital for spousal income and future inheritance, and the challenge and stress levels rise.

We regularly hear that the maximum level that one draws should be at most x or y. We also hear about the importance of beating inflation and the need to take exposure to growth assets. This is all good and well. But how much capital should one aim to accumulate by the time you retire, and what returns must one aim for to ensure a financially independent retirement?

The information I will provide here should not be seen as the “holy grail” to guarantee a fantastic retirement. It must be considered a guide to assist you along the way to retirement and in retirement.

Future expenses in retirement vary wildly between retirees, and it is almost impossible to determine today what future expenses may be. This brings me to the point that where you rely on living annuities and free capital reserves, including rental property or anything else that is not guaranteed, your ability to draw income and generate returns must be flexible and dynamic.

To start with a sustainable “pot” of capital that will provide you with either all or a part of your future retirement income requirement, I generally suggest that you aim for 150% of your required capital.

How do I determine what that magic figure is?

Start with your annual income requirement that you wish to receive when you retire;

Deduct all forms of other income that will contribute towards this figure, like rental property, royalties, defined benefit pension income, etc;

Divide the remaining income requirement by 5%; and

Multiply this amount by 150%.

Example:

Income requirement = R40 000 per month = R 480 000 per year

Deduct rental and other income, say R180 000 = R300 000 per year

Divide R300 000 by 5% = R6 000 000 capital requirement

Multiply the capital requirement by 150% = R9 000 000 safe capital requirement.

The safe capital requirement should be sufficient for unplanned expenses like future medical expenses, frail care costs, legacy provisions, holidays, etc. Keeping the actual income requirement at the same monetary value automatically means that a lower percentage of income will be drawn against the capital provision.

This is the first step to a more sustainable solution. In the example above, the 5% drawdown will reduce to 3.33% income drawn per year to achieve the R300 000 annual income that I referred to.

Some may argue that the above target is a bridge too far. What happens if you can only manage to accumulate the R6 million or less?

Unfortunately, legacy wishes and unplanned expenses become much more challenging, as does the requirement for higher returns. The less capital you have accumulated, the higher the drawdown percentage will drift as your income requirements and expenses increase. This will require a higher investment return.

Do not fall into the trap of ignoring the importance of additional returns required due to inflation creep.

A common mistake investors/retirees make is to consider their portfolio returns and believe that they will be fine if the returns are higher than the percentage of the income they draw. Nothing can be further from the truth.

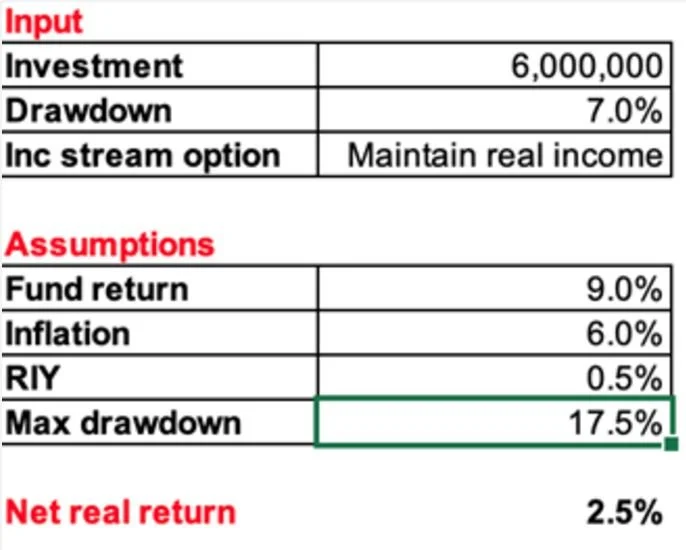

Consider the illustration below:

The following data was used in the illustration:

Even though the returns are 2.5% per year higher than the drawdown (9% return versus 7% drawdown and a 0.5% reduction in yield), the capital is only preserved for four years, after which it starts depleting due to inflation creep.

Income will keep track of inflation for 12 years, after which it will reach the 17.5% maximum limit of living annuities and start to reduce.

In the illustration, the purple graph represents the capital value, and the blue dot-line graph represents income. The results speak for themselves.

So, what returns are required to achieve capital and income sustainability if we assume inflation remains at 6% per year?

Once again, I request that you don’t treat the following as gospel but merely as a guide.

As a point of discussion and to try and get my point across, I generally comment that one needs to achieve double the returns of the percentage that you draw income against your investment if you want the capital to be sustainable for 35 years and income to keep track with 6% inflation per year. In other words:

If you draw 3% income, you need 6%+ returns.

If you draw 4% income, you need 8%+ returns.

If you draw 5% income, you need 10%+ returns.

If you draw 6% income, you need 12%+ returns.

Beyond 6%, income sustainability becomes questionable since one must then consistently earn returns of 14% or more per year. In simple words, if you draw more than 7% income per year, the odds are stacked against you to preserve capital and capital depletion becomes a real risk since consistent returns of more than 14% per year are very unlikely.

The one caveat we must recognise is how the returns are achieved. The above assumptions assume consistent returns every year. They do not consider negative years nor the consequences of the sequence of returns.

We also know that the higher return expectations are, the more volatile returns will be, and periods of negative returns are almost guaranteed. The longer the periods of negative returns persist, the greater the challenge will be to preserve capital.

Given these challenges, strategies must be implemented to improve one’s chances of preserving capital and keeping income in line with inflation. It is crucial to build up reserve funds to cover unplanned future expenses.

Some strategies to consider as alternative income sources may include:

Acquiring rental property over time.

Invest in guaranteed annuities (voluntary and compulsory) with some of your funds, not all.

Invest some funds in something like SA Retail Bonds.

Diversify your investment portfolio and invest across the risk spectrum, locally and offshore.

In retirement, practice a hobby or a sideline business that can generate income. This will not only relieve pressure on your investments but also help with the psychological challenges that many people experience in retirement.

It is also advisable to discuss these future outcomes with family members. If one is not able to accumulate sufficient funds to ensure long-term income sustainability or if your financial position may deteriorate to the extent that you will not be able to leave a legacy for children and others, tell them.

They should know the facts well in advance than have expectations and find out the reality when you can no longer explain this to them. It may just also give them time to prepare to help you financially if finances really become hard-pressed.

Should you be in a position where your finances are pressing and stressful, please avoid investing in schemes where false promises and unrealistic returns with fake guarantees are offered. Any guarantee above the risk-free rate (bank money market rates) carries risk. If one of the four large banks or another meaningful large corporation does not underwrite the guarantee, walk away.

If you don’t understand what you are investing in and the promise sounds too good to be true, avoid it. If you are unsure about a provider, contact the FSCA to confirm their authenticity.

Invest smart, stay safe, and plan well.